This summer, GCC visits to the UK are expected to surpass one million, with 70% of travelers focusing their time in London’s prestigious luxury districts. Now is the moment to capture this affluent audience—right where they shop, dine, and indulge. Explore how premium Out-of-Home (OOH) and the new pDOOH placements in Knightsbridge, Bond Street, and Heathrow Airport can provide unmatched visibility and influence, delivering your brand directly to this elite segment.

The GCC (Gulf Cooperation Council) represents a highly valuable travel market, with HNI (High Net Worth Individual) travelers demonstrating exceptional spending power and a penchant for luxury experiences.

London, a perennial favorite among GCC travelers, offers a unique opportunity for brands to connect with this affluent audience. This blog post explores how strategic Out-of-Home (OOH) advertising in London's key tourism locations can effectively reach GCC HNI travelers, maximizing brand visibility and driving ROI.

Target Audience: The GCC HNI Traveler

GCC HNI travelers are typically business owners, investors, and high-ranking professionals seeking premium experiences and luxury goods. They value exclusivity, quality, and convenience.

- High Spending Power: Spending three times the global average per trip (£2,578 vs. £860).

- Extended Stays: Averaging 16 nights compared to the global average of 7.

- Concentrated Activities: Primarily shopping and dining in luxury districts like Knightsbridge and Bond Street.

- Peak Travel Season: Predominantly traveling during June, especially post-Eid Al Adha.

- Tech-Savviness: High mobile device usage, with 76% using mobile devices to explore products featured in OOH ads.

- Strategic OOH Locations in London: Advantage of OOH Media:

OOH advertising offers unparalleled reach and frequency, ensuring your message is seen by a large and receptive audience. Its physical presence creates a lasting impression, reinforcing brand awareness and driving purchase decisions.

- Knightsbridge: Boasts the highest concentration of high-revenue visitors in Europe, with 43% classified as high-income demographics. Digital OOH locations here command premium rates but offer unparalleled access to the target demographic, especially near Harrods and luxury residences.

- Bond Street: Processes over 200,000 daily visitors during summer months, with 38% of GCC luxury transactions occurring at Bond Street retailers. Offers scalable investment options with standard billboards and premium digital screens.

- Heathrow Airport (Terminals 3 & 5): Handles the majority of Emirates and Etihad premium cabin arrivals. Premium digital screens in arrivals and baggage claim areas provide immediate brand exposure to fresh arrivals.

- West End: Projected to reach £10 billion annual turnover by 2025, with significant growth in visitor numbers. Offers high-impact visual executions that create premium brand associations.

Critical Success Factors for Campaign Planning

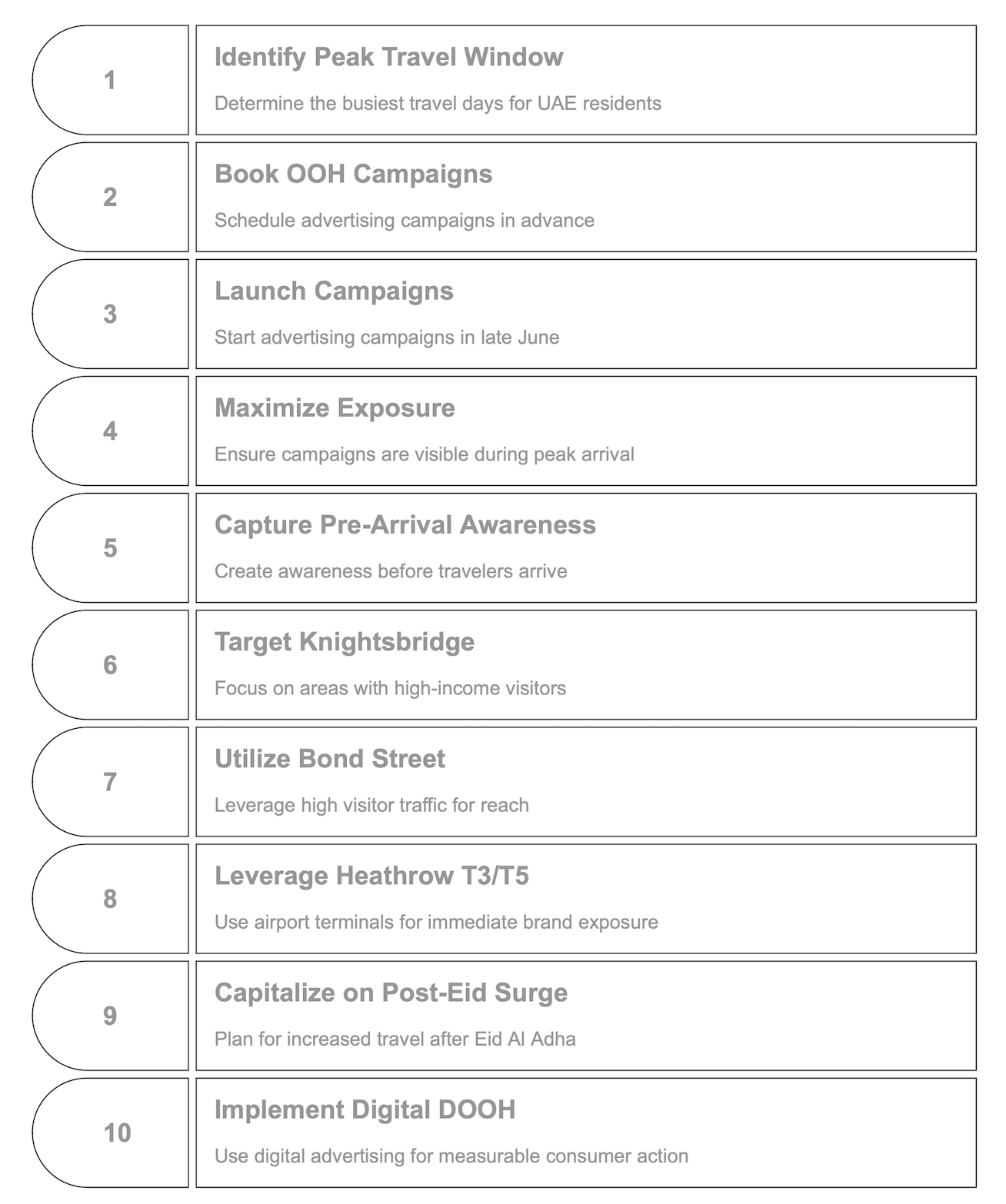

1: Peak Travel Window - July 11-19 is Prime Time

July represents the optimal advertising window, with July 11 and 19 identified as the busiest travel days for UAE residents traveling to London . Media planners should book OOH campaigns 2-4 weeks in advance, launching in late June to capture pre-arrival awareness and maximize exposure during the critical arrival period . This timing aligns with 31% of UAE visitors and 34% of Kuwaiti travelers arriving during the July-September period.

2: Knightsbridge Commands Premium Audience Concentration

Knightsbridge delivers the highest concentration of high-revenue visitors in Europe, with 43% of visitors classified as high-income demographics . Premium digital OOH locations in this district command higher monthly rates, justified by the fact that 70% of GCC travelers concentrate their shopping and dining activities in the Knightsbridge area . The proximity to Harrods and luxury residential properties ensures consistent exposure to the target demographic.

3: Bond Street Delivers Massive Reach with Proven Performance

Bond Street processes over 200,000 daily visitors during summer months, with 38% of GCC luxury transactions occurring at Bond Street retailers including Chanel, Louis Vuitton, and Tiffany & Co.

4: Exceptional Spending Power Justifies Premium Investment

GCC travelers represent extraordinary value with average spending of £2,578 per trip, three times the global average, with 50% of budgets allocated to fashion and 17% to leather goods .This spending concentration justifies higher CPM rates typical of luxury district advertising, as the superior customer lifetime value offsets premium placement costs.

5: Extended Stay Advantage Enables Frequency Building

GCC visitors maintain an average stay of 16 nights compared to the 7-night global average, providing extended exposure opportunities for OOH campaigns . This extended presence enables 4-6 week campaign durations that maximize repeated exposure and frequency delivery, significantly improving brand recall and engagement rates compared to shorter-term visitor segments.

6: Heathrow T3/T5 Provides Strategic Capture Point

Heathrow Terminals 3 and 5 handle the majority of Emirates and Etihad premium cabin arrivals, with peak arrival times occurring between 6-8 AM and 2-4 PM during July-August. Premium digital screens in arrivals and baggage claim areas offer immediate brand exposure to fresh arrivals before they disperse throughout London.

7: Post-Eid Al Adha and school holiday Surge Creates Booking Urgency

The period from June 17-31, 2025 (post-Eid Al Adha) generates a 40% increase in travel volume from GCC countries as schools close for summer holidays . Last-minute booking patterns show GCC travelers typically finalize plans 7-14 days before departure, requiring agile campaign launch strategies with early July activation and peak spending allocation for mid-to-late July.

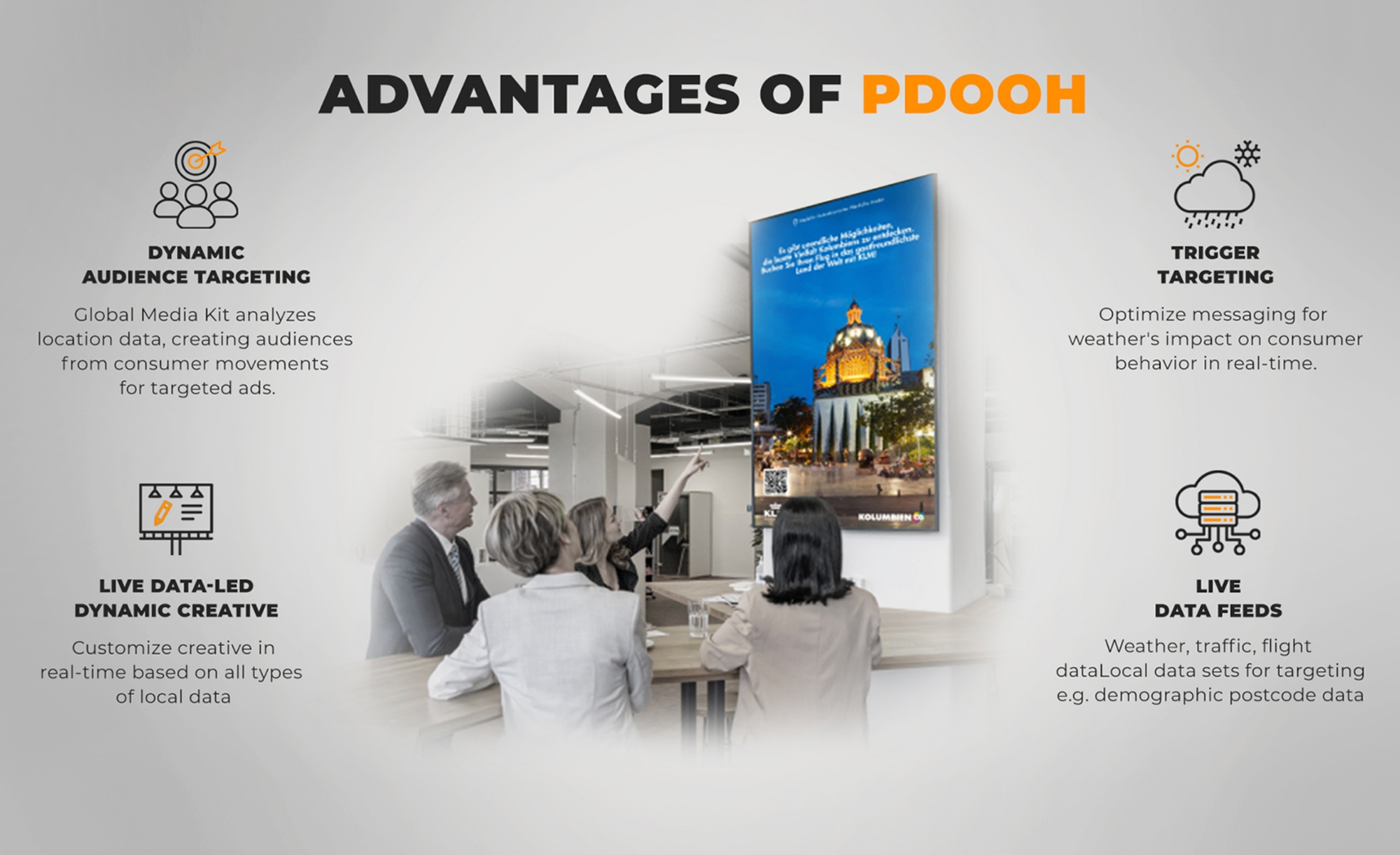

8: Digital OOH Drives Measurable Consumer Action

Digital out-of-home advertising achieves 78% consumer action rates, with 76% of viewers using mobile devices to explore products featured in OOH advertisements. Programmatic DOOH capabilities enable real-time optimization, weather triggers, and audience-based daypart adjustments that maximize campaign efficiency and provide measurable performance metrics.

9: Luxury OOH Delivers Superior Brand Engagement

Luxury brands experience 90% consumer engagement rates when utilizing OOH advertising, with the fashion and luxury sector representing 20% of total global DOOH spending . High-impact visual executions are treated as "art installations" rather than traditional advertising, creating premium brand associations essential for luxury positioning.

10: West End Recovery Momentum Supports Investment

London's West End is projected to reach £10 billion annual turnover by 2025, with sales up 109% compared to 2021 levels . Oxford Street alone processes 500,000+ daily visitors with 19% year-over-year growth at the eastern end, while the Elizabeth Line expansion is expected to bring 13% more visitors by 2025, supporting sustained advertising investment.

Connect with our experts to tailor your brand’s summer presence where it matters most.